Exploring Democracy, Reclaim the Republic – I

“On the 26th of January 1950, we are going to enter into a life of contradictions. In politics we will have equality and in social and economic life we will have inequality. In politics we will be recognizing the principle of one man one vote and one vote one value. In our social and economic life, we shall, by reason of our social and economic structure, continue to deny the principle of one man one value… How long shall we continue to deny equality in our social and economic life? If we continue to deny it for long, we will do so only by putting our political democracy in peril” – Dr. Babasaheb Ambedkar

As we move towards 26 January, let us remind ourselves of what the chief architect of our Constitution, Dr. Babasaheb Ambedkar, had to see about the nature of “democracy”. Ambedkar was crystal clear that political democracy was incomplete and even meaningless without social and economic equality. More than 65 years after India officially became a Republic, both social and economic ‘inequality’ that Ambedkar warned us of stubbornly persists. And this inequality persists precisely because of the lack of political will to address inequality.

Let us have a look at some facts.

French Economist Thomas Piketty, shows that income and wealth concentration in India today is amongst the HIGHEST in the world. According to Credit Suisse’s Global Wealth Databook, in 2014, India’s richest 10 per cent own nearly 75% of total wealth in the country. Even in the US, top 10%’s income share is 45-50 % of total income. In Europe this share is much lower, at 30-35 per cent.

In 2014, India’s top 1% held close to 50% the country’s total wealth, according to Credit Suisse’s Global Wealth Databook.

India has the highest share amongst the poorest 40% people in the world.

What are the global figures?

According to a recently released Oxfam World Inequality report, 62 richest persons in the world own as much the poorest 50% of the world’s entire population’s wealth. In 2010, it required the richest 388 persons to make up the wealth of the bottom 50%. Since then, the world’s richest 62 persons have added 44% to their cash and assets while the wealth of the bottom half has dropped by 41% despite an increase in the global population of 400 million. Within five years, the majority of the world’s wealth has been consolidated into the hands of less than one-sixth of the number of persons who used to control it.

Nine out of 10 World Economic Forum corporate partners had a presence in at least one tax haven and it was estimated that tax dodging by multinational corporations costs developing countries at least $100 billion every year. Corporate investment in tax havens almost quadrupled between 2000 and 2014.

80% of the world’s populations owns ONLY 5.5% of the global wealth.

This wealth inequality is NO accident. The Oxfam report points out that the world’s most wealthy people spend enormous amounts of their money each year on lobbying efforts designed to defend the assets they have and expand their ability to make even more. “The most prolific lobbying activities… are on budget and tax issues; public resources that should be directed to benefit the whole population, rather than reflect the interests of powerful lobbyists”. And several pliant governments allow them to do so.

“One particular thing that was never really done in India was growth-based investment in basic schemes, basic education, health… I think there is no example of a country that has become rich with such a low level of taxation as what we have in India today. This is simply the evidence” – Thomas Piketty

During his recent visit to India, Piketty talked about the huge dangers of growing inequality in India. Underlining the measures required to address inequality, Piketty stressed the need to tax the rich far more in India. He pointed out that the tax-to-GDP ratio in India is less than 11%, and in fact India has ZERO wealth tax! Therefore, India struggles to meet challenges of inequality. According to Piketty, the tax-GDP ratio should be between 30-50%, if India that really serious about addressing systematic deprivation, poverty and inequality.

The Paradox of Our Republic: The paradox and doublespeak of our economy is turned into a ‘common-sense’ through a cleverly-crafted vocabulary perpetuated by academics, media and the corporate as well as political establishment.

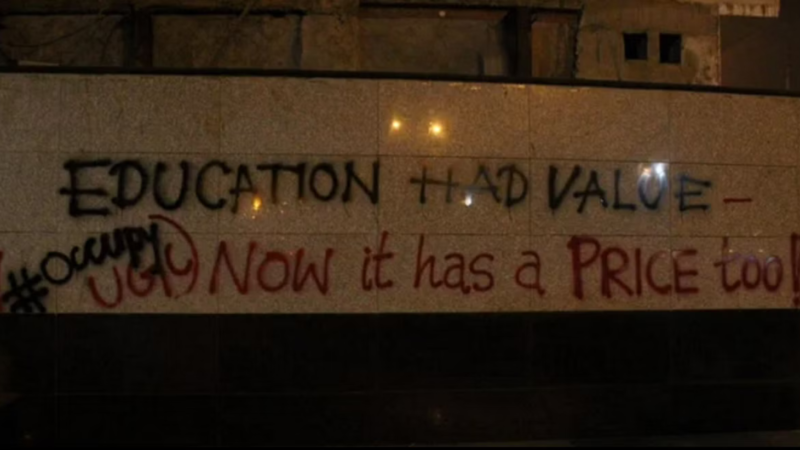

Public Funds for Corporates is called ‘Incentive’, Same for the Poor is ‘Subsidy: Public money, land and other natural resources handed over to super-rich corporates for profiteering is an ‘incentive’, something necessary, essential and “good”. Yet, public money used for supporting subsistence farmers, for funding education and healthcare, for expanding the scope of fellowships and scholarships for students, for ensuring food security for India’s poor – are cleverly termed as ‘subsidies’ which are a ‘fiscal burden’ and must be done away with.

Concessions for Corporates is ‘Desirable’ for a ‘Level Playing Field’, but Reservations for Deprived Students is against ‘Merit’ and ‘Efficiency’: Corporate houses routinely demand funds and various waivers from governments, in the name of ensuring a “level playing ground”. But, when farmers demand public funding and infrastructure in order to survive, suddenly using public funds becomes “trade distorting” and undesirable. When students from deprived backgrounds demands reservations and scholarships in order to enter institutions of higher education and jobs, in order to ensure a truly “level playing ground”, all sorts of excuses are trotted out to deny these demands and deride the idea of “reservations” by the very same corporates and their ideologues in media, academia and politics!!!

India’s public health system has a budget of barely 0.5 per cent of GDP, compared with almost 3 per cent in China. In the education sector too, India’s investment is pitifully low as we are well aware. The simple solution for this ensuring lack of investment would be to increase taxes, and extract resources from the super-rich to fund public health, education and infrastructure. But successive governments have of course refused to do so.

The Modi government has in fact gone in the opposite direction! It has announced its intention of reducing the rate of taxation of corporate incomes to 25 per cent, a rate which is even lower than in rich countries.

The modus operandi of the current government is simple:

Firstly, DO NOT tax rich corporate houses, do not collect money from the rich. Give them massive tax breaks, sops and huge bank loans from public banks – all in the name of ‘incentives’. Every year, more than 5 lakh crores is the revenue willingly foregone by the Indian government, in its bid to defend corporate profits. That is, the government could have collected 5 lakh crores EXTRA every single year, and used it for education, healthcare and agriculture. But it didn’t.

Secondly, after facilitating massive loans to corporate houses, funded by public-sector banks, DO NOT ask the corporates to pay back! 37 banks, led by public sector ones, have reported a 26.8 per cent rise in non-performing assets (NPAs) or bad loans over the 12-month period ending September 2015. NPAs here refers to unrecovered bank loans given by the banks. This is a nearly 10 per cent rise from the 16.9 per cent growth in bad loans over the same period a year ago. The banks with a major share in bad loans include Bank of India, Bank of Baroda, Indian Overseas Bank, SBI and Punjab National Bank.

Who profits from these unrecovered loans? As the table here shows, it is the likes of Adanis and the Ambanis who benefit! Just the unrecovered loans from ONE company, Reliance, equals the entire much-touted Special Package for Bihar (1.25 lakh crores)

Thirdly, spend absurdly small amounts of public money on education, health care, sanitation and basic infrastructure. Tell people that the government “has no money” to fund scholarships for students, subsidies for farmers, or for MNREGA and PDS.

As we approach yet another Republic Day, let us remember Babasaheb’s vision of social, economic and political democracy. This existing inequality is an insult to his vision, and to the spirit that he tried so hard to enshrine in the Constitution.